In the dynamic world of retail, seizing the right moment can make or break a brand, and Foot Locker's handling of Eastbay stands as a fascinating case study of missed opportunity. Once a powerhouse in the sporting goods market, Eastbay's mail-order catalog was a beacon for serious athletes, offering performance athletic gear that was unparalleled in its reach and influence [^1]. However, as the retail landscape evolved, Foot Locker failed to capitalize on Eastbay's potential to become the "Amazon of sporting goods," instead choosing to chase "Sneakerhead" cluster, divest its Team Sales Business and shutter the Eastbay website. This oversight, akin to missing a 'Netflix moment,' allowed competitors like Dick's Sporting Goods to rise with a diversified strategy focused on serving team sports athletes and families eventually allowing them to acquire Foot Locker itself. By examining Eastbay's history and Foot Locker's strategy, we uncover essential lessons on the importance of innovation and the risks of stagnation in a fiercely competitive market.

[^1]: Remembering the beloved Eastbay shoe catalog

Eastbay's Unique Market Position

Eastbay's position in the sporting goods market was once unrivaled. Its unique approach to retail, centered around a mail-order catalog, set it apart from other players in the industry. The following sections delve into Eastbay's origins, Foot Locker's missteps, and the power of a once-dominant mail-order system.

Eastbay History and Growth

The roots of Eastbay stretch back to the late 1980s when it emerged as a go-to destination for athletes seeking specialized athletic wear. Founded by two high-school friends, the company quickly gained traction by focusing on hard-to-find performance athletic gear. Their dedication to quality and authenticity resonated with serious athletes, propelling Eastbay to national prominence.

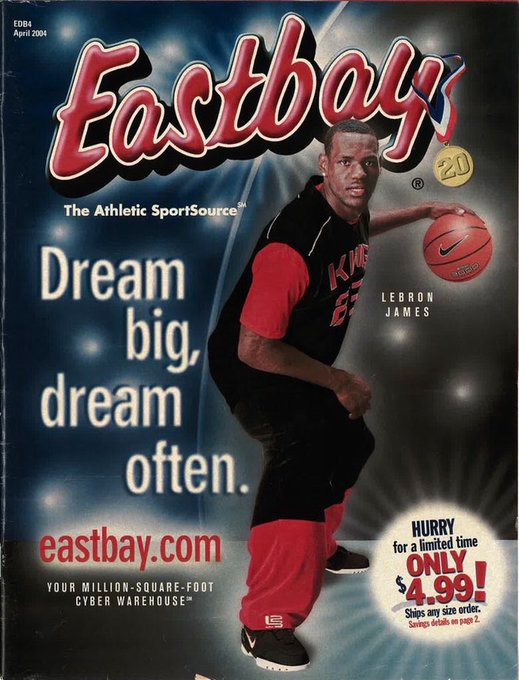

The company's growth was fueled by its innovative distribution model. Utilizing a comprehensive mail-order catalog, Eastbay reached millions of households. This catalog was more than a sales tool; it was a touchstone for athletes who valued access to premium gear. Its reach and effectiveness were unparalleled in an era before digital retail.

By the early 2000s, Eastbay had established itself as a formidable presence in the sporting goods market. Its success was not just in sales, but in brand loyalty. Athletes associated Eastbay with quality and reliability, a reputation that seemed unshakeable at the time.

Foot Locker Strategy Missteps

When Foot Locker acquired Eastbay, expectations were high. The potential for synergy between Eastbay's niche market and Foot Locker's expansive retail footprint was immense. However, the execution fell short. Foot Locker's strategy failed to leverage Eastbay's strengths, leading to a gradual decline.

Foot Locker's first strategic misstep was to neglect Eastbay's core audience. Instead of enhancing the brand's unique identity, Foot Locker attempted to integrate it too deeply into its existing framework. This diluted Eastbay's distinct appeal, alienating its loyal customer base.

Another significant error was the decision to divest Eastbay's Team Sales Business. This segment had been a cornerstone of Eastbay's success, providing customized solutions for teams and institutions. The divestment not only reduced Eastbay's market share but also weakened its competitive edge. The sale to BSN Sports only highlighted this oversight [^1].

[^1]: BSN Sports Acquires Eastbay Team Sales

The Power of the Mail-Order Catalog

Eastbay's mail-order catalog was more than just a list of products; it was a cultural icon. In a pre-digital era, it connected athletes to the gear they needed in a way no other medium could. Its success was due to several factors that made it indispensable.

Firstly, the catalog offered an extensive range of products that were often unavailable in local stores. This accessibility was crucial for athletes living in remote areas. Secondly, the catalog's detailed product descriptions and high-quality imagery provided an in-depth shopping experience that was informative and engaging.

The catalog also served as a branding tool, creating a sense of community among its readers. It was not uncommon for athletes to discuss and share the latest editions, further cementing Eastbay's status as a trusted resource. The catalog's impact extended beyond sales; it was a symbol of Eastbay's commitment to the athlete's journey.

Missed Opportunities in Sporting Goods

Foot Locker's failure to capitalize on Eastbay's strengths is a textbook example of missed opportunities. This section explores the potential lost with the Team Sales Business, the intensifying retail competition, and the rise of new market leaders like Dick's Sporting Goods.

The Lost Potential of Team Sales Business

Eastbay's Team Sales Business was a vital asset that Foot Locker failed to appreciate fully. This segment catered to schools and sports teams by providing customized gear and apparel solutions. It represented a significant portion of Eastbay's revenue and offered an avenue for brand expansion.

The decision to divest the Team Sales Business was short-sighted. By selling it off, Foot Locker forfeited a competitive advantage that could have been leveraged to dominate the team sports market. The sale to BSN Sports marked a turning point, signaling a shift in priorities that didn't align with Eastbay's original mission.

This move had several repercussions. It weakened Eastbay's market position and allowed competitors to fill the void left behind. The loss of this business also meant losing valuable customer relationships and insights that could have been used to drive future growth.

Retail Competition Heats Up

As Foot Locker struggled to integrate Eastbay, the retail competition in sporting goods intensified. New entrants and existing players alike began to innovate, offering consumers a wider range of options and better shopping experiences.

Key competitors capitalized on Foot Locker's oversight by emphasizing digital sales channels. Online retail giants expanded their sports offerings, providing convenience and variety that traditional mail-order couldn't match. Innovative marketing strategies and dynamic customer engagement became the norm, driving consumers away from outdated models.

Moreover, these competitors embraced a multi-channel approach. By combining brick-and-mortar stores with robust online platforms, they offered seamless shopping experiences that appealed to a tech-savvy audience. Foot Locker's reluctance to adopt such strategies left it vulnerable to shifting consumer preferences.

The Rise of Dick's Sporting Goods

Dick's Sporting Goods stands as a prime example of how to navigate the evolving sporting goods landscape. Unlike Foot Locker, Dick's embraced a diversified strategy early on, focusing on both digital innovation and in-store experiences.

Dick's success can be attributed to several factors:

- Adaptation to market changes: Dick's continuously evolved its product offerings and retail strategies to meet consumer demands.

- Investment in digital infrastructure: By prioritizing online sales channels, Dick's provided a convenient shopping alternative that resonated with modern consumers.

- Customer-centric approach: Personalized services and a wide range of products fostered strong brand loyalty among its customers.

The acquisition of Foot Locker by Dick's Sporting Goods highlights the latter's strategic foresight. By integrating Foot Locker's assets, Dick's can further consolidate its market position and continue its growth trajectory.

Lessons in Innovation and Adaptability

The story of Eastbay and Foot Locker offers valuable insights into the importance of innovation and adaptability in retail. This section outlines key lessons on how to secure a niche for growth and explore the impact of Dick's Sporting Goods' strategic decisions.

Importance of Innovation in Retail

In the competitive world of retail, innovation is not just beneficial; it is essential for survival. The failures of Foot Locker and the successes of Dick's Sporting Goods underscore this reality. Retailers must continuously innovate to keep pace with changing consumer expectations and technological advancements.

Innovation can take many forms. From adopting new technologies to reimagining customer engagement, the possibilities are vast. Retailers who embrace innovation are better positioned to anticipate market trends and respond swiftly. This proactive approach can differentiate a brand and secure its place in the market.

For Foot Locker, the lesson was costly. By failing to innovate, it missed the opportunity to transform Eastbay into a digital powerhouse. This oversight serves as a cautionary tale for retailers worldwide: rest on your laurels, and the competition will surpass you.

Securing a Niche for Growth

Securing a niche is critical for long-term retail success. Eastbay's history illustrates how a focused approach can build a strong brand identity and customer loyalty. However, maintaining that niche requires continuous adaptation and strategic foresight.

To secure a niche, businesses should:

- Identify and understand their core audience: Tailor products and services to meet specific needs.

- Stay agile and responsive to market changes: Adapt strategies as consumer preferences evolve.

- Invest in unique value propositions: Differentiate the brand from competitors through exclusive offerings and experiences.

Eastbay's initial success in the athletic wear niche was commendable, but its failure to adapt ultimately led to its decline. This highlights the importance of not just finding a niche, but actively nurturing it.

Lessons from Dick's Sporting Goods Acquisition

The acquisition of Foot Locker by Dick's Sporting Goods is a testament to strategic adaptability and vision. This move offers several lessons for industry leaders and entrepreneurs:

- Diversification is key: A broad product range and diverse sales channels can buffer against market fluctuations.

- Customer experience matters: Investing in personalized, seamless shopping experiences fosters loyalty and repeat business.

- Strategic acquisitions can drive growth: By acquiring Foot Locker, Dick's can enhance its market position and capitalize on synergies.

These lessons emphasize the need for a forward-thinking approach in retail. As market dynamics shift, businesses that prioritize innovation and adaptability are more likely to thrive.

About Nick Palazzo

Nick Palazzo is an industry recognized sports technology entrepreneur and marketing innovator appearing in numerous publications and broadcast programs, including The New York Times, the “Today” show, Mediaweek, MIN, Folio, Sports Business Journal, Forbes and Adweek, and is a frequent keynote and panel speaker at sports, media and technology industry events. Earlier in his career, Nick Palazzo was featured as a “C-Level Visionary” by Folio as part of its annual Folio:40 list of media industry influencers and innovators, which included President Barack Obama. Palazzo was also featured in the acclaimed book Upstarts! How GenY Entrepreneurs are Rocking The World of Business.

LinkedIn Profile: https://www.linkedin.com/in/nick-palazzo/

X Profile: https://x.com/nick22palazzo

Instagram Profile: https://www.instagram.com/nick22palazzo

Personal Blog: https://www.nickpalazzo.com/